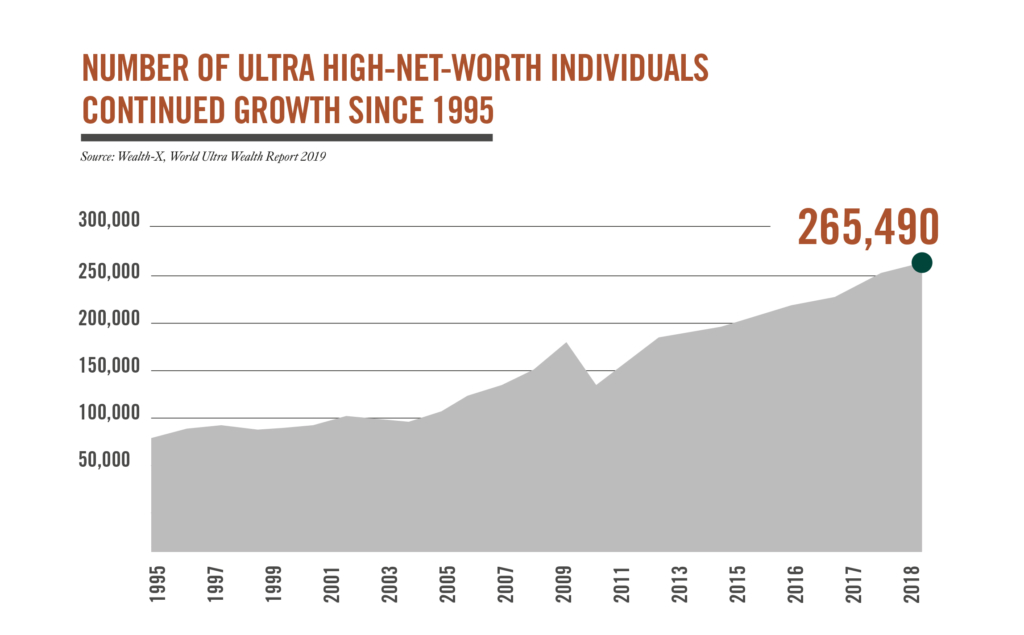

During the presentation in January of the Global Property Handbook 2020, when the coronavirus crisis had not yet reached its global dimension, BARNES established, as every year, an update on the evolution of the UHNWI population (Ultra High-Net-Worth Individuals, individuals or families holding fortunes of at least 30 million dollars available for investment). With this question: "Could we be on the verge of a turnaround?"

The number of UHNWIs in the world increased by +0.8% in one year to reach 265,490. This represents a net slowdown in growth since 2015. At the same time, their combined wealth stood at $32,300 billion, showing a slight decrease in the average net wealth of each UHNWI.

Regional differences are to be noted, ranging from near stability in UHNWI wealth in the Middle East to a drop of -7% in Latin America and the Caribbean. Indeed, the Middle East saw a notable increase in the number of UHNWI over the last year (+6.8%), while North America and Europe recorded much more modest growth (+1.4 and +2.5%). The other four regions (Asia, Africa, Pacific, Latin America and the Caribbean) recorded sharp declines in their UHNWI population.

Flexibility is now a priority

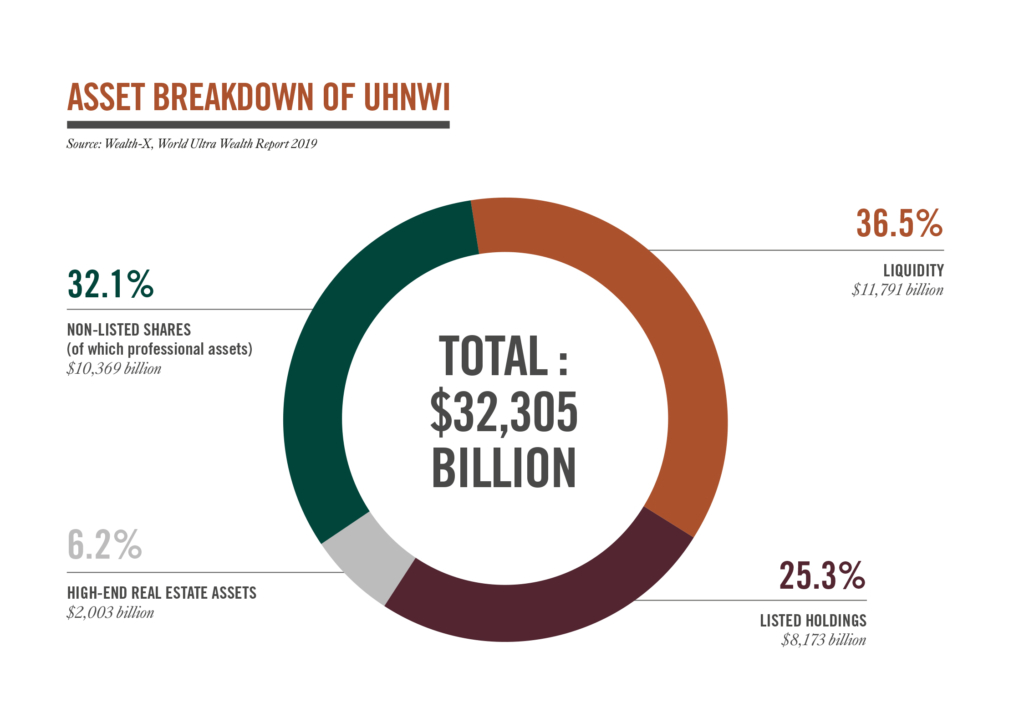

The breakdown of major holdings in the global UNHWI population has changed little in a year. Liquidity (cash, income and dividends) rose to 36.5% of the total, representing a slight increase compared to 2018, where they accounted for 32.3%. This increased liquidity is partly a reflection of what is known as the "new standard", i.e. less rapid global economic growth than we experienced before the 2007-2010 financial crisis.

Flexibility is now a priority, as the pursuit of returns, in an environment of extremely low interest rates, high stock valuations and capital market turmoil, has weakened traditional banking sectors and intensified geopolitical uncertainties. The slowdown in global growth and the poor performance of stock markets have most likely contributed to investor caution: just under a third of the UHNWI portfolio is made up of stocks in unlisted private companies.

The proportion of listed holdings remains relatively stable, i.e. around a quarter of the total assets of UHNWI. The remaining 6.2% mainly concerns high-end real estate but also includes yachts and private jets. High-end real estate is perceived by this clientele as the ultimate safe haven in a context of structurally inferior supply vs demand for almost thirty years. Indeed, the number of international cities and luxury resorts remains limited in the face of continued growth in the number of UHNWIs and their wealth. Moreover, and in an uncertain global economic environment, excess liquidity should eventually benefit the asset class invested in high-end real estate, whose current share (6.2%) is expected to grow over the next few years.

BARNES global property handbook 2020

Voir cette page en Français